Table of Contents

BASIC TDS PROVISIONS

TDS (Tax Deducted at Source) is a crucial mechanism under the Income Tax Act,1961 to collect tax in advance from the Assesse. Let’s See the other aspects of TDS provisions:

Purpose of TDS: TDS stands for Tax deducted at source. It was introduced to collect taxes directly from the source where income is generated. The Govt. uses it as a tool to minimize tax evasion by taxing income at the time it is earned, rather than at a later date.

Applicability: Entities making specified payments (such as salary, commission, professional fees, interest, rent, etc.) are required to deduct tax before disbursing the payment to the recipient.

Liable Person to Deduct TDS: Following person are liable to Deduct TDS

- Company

- Partnership Firms Including LLP

- Any individual or HUF whose books of accounts were audited during the Previous year as per Income Tax Act 1961.

Having a TAN (Tax Deduction and Collection Account Number) is mandatory for deducting TDS.

HOW TO APPLY FOR TAN NUMBER

Below are the Steps to apply for the TAN Number

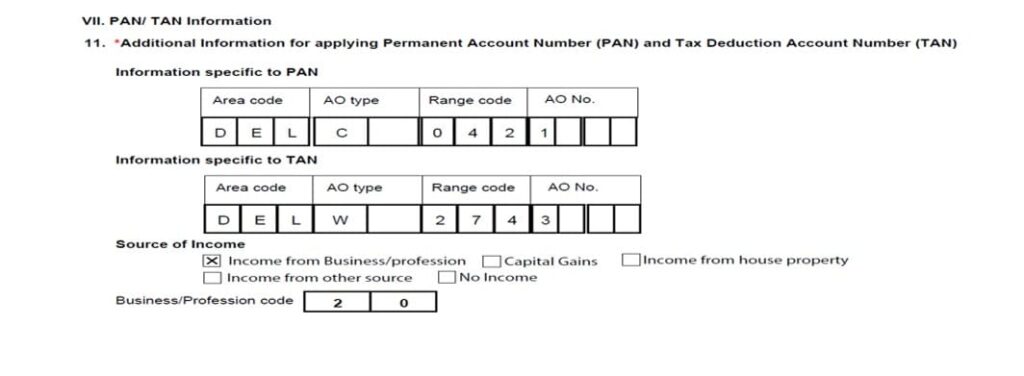

For Companies: Now company can apply for TAN Number through the incorporation form, below is the Screenshot for your reference

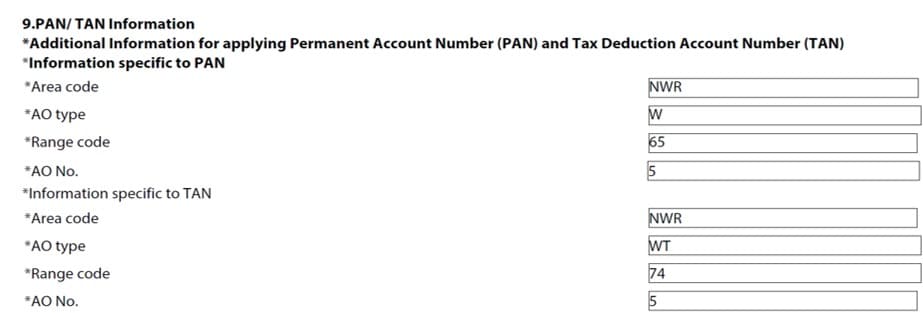

For LLP: Similarly, LLP can also have TAN number while incorporating the firm through FILLIP Form. Below screenshot for your reference

Partnership Firm, Individual or HUF: Need to apply for the TAN Number Online or Offline.

DUTIES OF A PERSON RESPONSIBLE FOR DEDUCTING TDS

- The person responsible for deducting TDS must deduct tax at the time of making payments.

- TDS should be deposited to the government before the due date.

- Every person deducting tax must file quarterly statements of TDS

- Issue TDS Certificate to deductee- Form 16 (for salaried) and Form 16A (for others)

DUTIES OF A PERSON RESPONSIBLE FOR DEDUCTING TDS

- The person responsible for deducting TDS must deduct tax at the time of making payments.

- TDS should be deposited to the government before the due date.

- Every person deducting tax must file quarterly statements of TDS

- Issue TDS Certificate to deductee- Form 16 (for salaried) and Form 16A (for others)

DUE DATE FOR TDS DEPOSIT

- TDS deducted in each month except March – 07th of the Following month

Month of deduction: April 2023

Due date for depositing TDS: May 7, 2023

WHAT IS TDS RETURN

- For TDS deducted in March month – 30th of the Following month.

Month of deduction: March 2024

Due date for depositing TDS: 30th April 2024

DUE DATE FOR FILING TDS RETURNS

TDS RETURN / FORMS

- Form 24Q

- Form 26Q

b. Quarterly filing

c. Filed by person who held the responsible for deducting TDS

d. Details required: PAN Number and address of the deductee, Payment made, and TDS deducted.

- Form 27Q

f. Quarterly filing

g. Filed by person who held the responsible for deducting TDS

h. Details required: PAN Number and address of the deductee, Payment made, and TDS deducted